Tax season readiness

Tax season is right around the corner. Are you ready? It can be a hectic time of year, but don’t worry—you’ll be well on your way to a stress-free tax season if you follow our five tips.

1. Start planning now

It’s important to get started early. Don’t wait until April 14 to rush to make a tax appointment or file your tax return. Rushing leads to mistakes—like leaving money on the table because you forgot to claim a particular deduction.

If your accountant hasn’t provided one already, reach out and request a checklist to ensure you’re gathering all required information, including important tax documents and business expenses. Also, don’t forget to make your tax planning appointment with your accountant—the earlier, the better.

2. Organize and digitize your documents

During the month of January, companies will begin sending out and receiving essential tax documents. Use this time to find the documentation you’ll need and start scanning and organizing it. Not only will you be able to recycle the paperwork, but you’ll make it easier to organize and submit your documents for tax preparation. Accountants love clients that go digital!

While this list isn’t all-inclusive (check with your accountant for exactly what you need), below are the general documents you’ll want to prepare for your accountant:

Income items may include gross receipts from sales or services, interest or dividends from business checking or savings accounts, and other income such as that from rentals, grants, etc.

Cost of goods sold such as beginning and ending inventory dollar amounts, inventory purchases, and materials and supplies.

Expenses like advertising, transportation and travel, computer and internet, contract labor, commissions and fees, insurance, interest expenses, and depreciation.

Other items such as advance payment notices, estimated tax payments, charitable contributions and financial statements (e.g., balance sheet, profit/loss statement, cash flow statement).

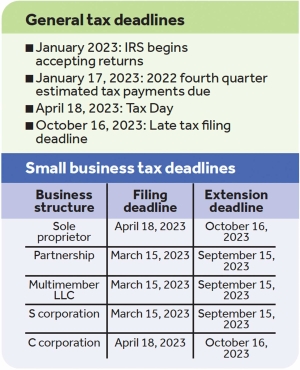

3. Know important deadlines

While your tax preparer will provide important tax deadlines, it’s also important for you to keep track of them, too. Be sure to check the IRS website for the most accurate and up-to-date information.

4. Familiarize yourself with tax credits

Tax laws are constantly changing, which means tax credits are, too. Your accountant will help you navigate through possible credits, but you want to make sure you’re aware of those that will help you and your business.

The first place you want to look is the IRS website¹—as it lists a large number of possible business credits you may qualify for to reduce your total tax bill. They can include credits for small business health insurance premiums (Form 8941), employer credit for paid family and medical leave (Form 8994), work opportunity credits (Form 5884), or credit for employer-provided childcare facilities and services (Form 8882), among others.

5. Use your accountant’s client portal

Keeping up with paper documents makes tax preparation a bit clunky and unorganized. Be sure to use your accountant’s online portal to store and organize your financial documents securely. Doing this will help save you (and your accountant) valuable time during tax prep.

Using a portal streamlines the tax preparation process and gives your accountant easy access to your essential tax information at any time and from anywhere. And many firms use portals that offer you access via a smart device, such as a phone or tablet. Quickly and easily review your tax return and provide an e-signature—all in one place

The time is now

Before you know it, tax season will be here. Stay as stress-free as can be with these five tips. Our best advice? Get started now and reach out to your accountant with any questions. Here’s to a successful tax season in 2023!

¹“Business Tax Credits,” IRS, November 10, 2022.

Back to issue